With respect to the last post, the Republican House has now passed an update to Obamacare.

And America is unhinged about it.

First off, it’s not a law yet, and it’s not clear it will be.

Second, it’s not a repeal.

If that word is on your lips, you should probably just bite your tongue until the feeling passes. It isn’t a repeal. The thing is, that word is on everyone’s tongue. Unfortunately, like most of the work in Washington, this bill attempts to fix a Frankenstein monster by excising some parts, stapling on some other parts, and coloring over the whole thing with Sharpies. Here’s a summary.

Third, it keeps some of the bad parts.

Get the message: Republicans like helping people with pre-existing conditions, it’s just that Democrats love helping them. Politically, this is a no-brainer for both parties. The thing is, everyone has the good sense to not put up with nonsense like this in other areas of life. Both parties need our help on this one to develop some fortitude (more on this several paragraphs down).

A huge problem with this is the perception, sold through anecdotes, that this is a common problem. It isn’t. Most of what gets labeled as a pre-existing condition issue is just people who won’t/can’t pay their bills. That’s unfortunate, but it is different, and it requires a different solution. The actual proportion of pre-existing-condition-health-insurance-conflicts is about 1 out of every 3,000 people. That is a small problem to address: would you sacrifice 1/3000 of your healthcare to help these people? Of course you would. Who wouldn’t? This could be covered with $10-20 a year from every person insured through their employer. That is chump change comparable to the taxes and fees that anger people on their phone bills. OOH OOH … wait for it … and you already pay something like this with your auto insurance. So it can be done. It isn’t done because when we start substituting feeling for thinking, politicians see opportunities to spend other peoples’ money. We now have a huge bureaucratic edifice built around the public perception that uninsured sick people are a huge problem, while we have zero bureaucratic edifice built around the fact that some drivers on the road are uninsured and the disturbing corollary that they’re not the best drivers. Politicians of all stripes view the solution to the uninsured motorist problem as something they do not want to repeat with healthcare.

A far smaller negative is the continuation of the right to continue to have your kids covered by your family’s health insurance plan through the age of 26. Macroeconomically this is a requirement that everyone’s paycheck be smaller so that some generally healthy people stay covered. It sounds nice, and it is nice. But follow the money: who is helped by allowing parents to continue to have higher premiums withdrawn from their paychecks that really don’t get spent covering people who use the least healthcare? In short, it’s a backdoor transfer to heavier healthcare consumers. It’s weird, and it’s dodgy, and we should know better.

Fourth, here’s the more cosmetic updates.

- Firms are freed up at the low end: they no longer have to offer health insurance.

- Firms are also freed up at the top end: a tax on high end health benefits has been pushed off ten years into the future.

The above two sound problematic, and they may well prove to be. But be clear-headed about this: it’s a move back to the system that we had from the 1940’s through 2010. For firms, it’s still cheaper to pay employees with healthcare than it is to pay them with cash.

The primary issues with that are not whether or not they want to (Tom Perez notwithstanding). The primary issues are if they can afford to pay their employees at all (you know … staying open, no layoffs, stable hours), and how much latitude they have to deal with your compensation if your productivity doesn’t keep up with the healthcare they promised to pay you with (you know … stay under 50 employees, and keep people under 30 hours).

- Keep your eye on the ball: Obamacare was not really about improving coverage so much as improving the chances that provided services were actually paid for. The new bill pushes more billing back in the direction of consumers (which is a good thing), except that consumers have a poor history of consuming their healthcare first, then maybe sorta’ paying for it later. And yes, the cost is part of that.

- That last one means hospitals are going to be hurt (doctors’ offices have an easier time of avoiding people who are unlikely to pay).

- A corollary to those last two is that Medicaid will shrink a bit. For all the talk about Obamacare improving coverage, on the ground that mostly amounted to pushing people into Medicaid who probably could’ve gotten Medicaid before but were (maybe) too dysfunctional to follow through on that. The problem with this is that Medicaid itself sucks: it does not pay its bills completely or in a timely fashion. All of those stories you hear about doctors not accepting new Medicaid patients, or regions having no Medicaid providers, lead right back to Congress making promises they don’t keep. One wonders how people like Bernie Sanders can even praise Medicaid without breaking out laughing: are they doing it on a dare or something?

- Obamacare’s main source of bleeding is health insurers fleeing the exchanges. Democrats didn’t address this when they had a chance, and Republicans didn’t do anything about it either. I think there’s a big disconnect here between whether these things should or can be fixed. Republicans don’t think they can be, so they’re not trying. Democrats take the view that they should be fixed, but don’t seem to like to address whether they can be fixed at all. That’s not a policy, it’s a wish. The fact that they didn’t fix the exchanges when they had a chance makes me think they knew it wasn’t worth the effort, but didn’t want to take the blame.

- Individuals without employer provided health insurance will face less penalties if they don’t self-insure. That’s what they want as individuals, but it isn’t very good for the system as a whole. The Democrats approach with Obamacare was to push people to buy something they didn’t really want. The Republicans have moved in the direction of pushing less, but encouraging more and cheaper choices. Yes, those could be worse. But in every aspect of life, we seem to like the riding-the-plane-in-coach model better, so why should healthcare be any different?

- The whole debate about pre-existing conditions seems divorced from reality. No one would put up with this nonsense with auto insurance: for one reason or another you are not insured, you didn’t get insured, then you had an accident, and now you want to buy insurance that you didn’t buy just a few minutes ago? With cars, we would label someone who behaved that way as a jerk. And talking about the cost of the insurance is a dodge. The fact is that the accident changed your preference for what you want to spend your money on. But anyway, the Republicans didn’t change Obamacare’s requirement that insurers put up with this crap. What they did do is relax, somewhat, the extra that insurers can charge you for changing your mind. Oh … and they recognized that this is problematic and threw a ton of money out there to help people adjust to this, a move Democrats never considered. How much? Between a third and half of the cost of “The Wall”. Sounds like serious money to me.

- The Obamacare approach to getting the folks from the last two points to buy insurance was to threaten them with a small stick (the modest tax penalty that was rarely enforced). The Republican approach is to give them a carrot with tax credits.

- The Republicans aren’t going to cut people who are currently in Medicaid. But they’re going to keep new people from joining for coverage reasons. That’s probably a good thing, since the political will to make sure Medicaid pays its bills is just not there. But, they merely promised to fix that. Don’t hold out much hope for that. Democrats didn’t fix it either, but I wouldn’t hold that against them. I would point fingers at them for viewing one of the few things we know is not working as the thing that was going to make Obamacare work at all. When Democrats say that Republicans are mean, I think they have a lot to answer for on this one.

- The Republican plan will make old people cough up more money. This is a good thing: they are the richest group in the country, and they consume the most of what they’re going to pay more for. The problem is that they vote. Republicans will get killed on this if they don’t watch out. But they’ve made a big bet on the future by tilting reform towards the young. Democrats are still pissed that Reagan got so many young people on his side.

- States are going to be funding a bigger proportion of healthcare for their residents. But they will get greater flexibility in how to do so. This is a big slam on the grayer populations of the northeast and midwest. But, Republicans are running most of the country at the state and local level, and they want out of the top-down Washington model of how to run their states.

Oh, and Republicans are keeping a good piece of Obamacare: the general trend away from paying for services to paying for outcomes has not been touched. If Obamacare changed the terms of that debate, it is an unalloyed good thing.

**************************************************

Keep your eye on the ball, folks.

If you need healthcare, on average you’re better off getting it in the U.S. than anywhere else. If that doesn’t change, we’re still on the right path.

But, you get what you pay for: Obamacare is a Cadillac, and Trumpcare is a Lincoln. The similarities are bigger than the differences.

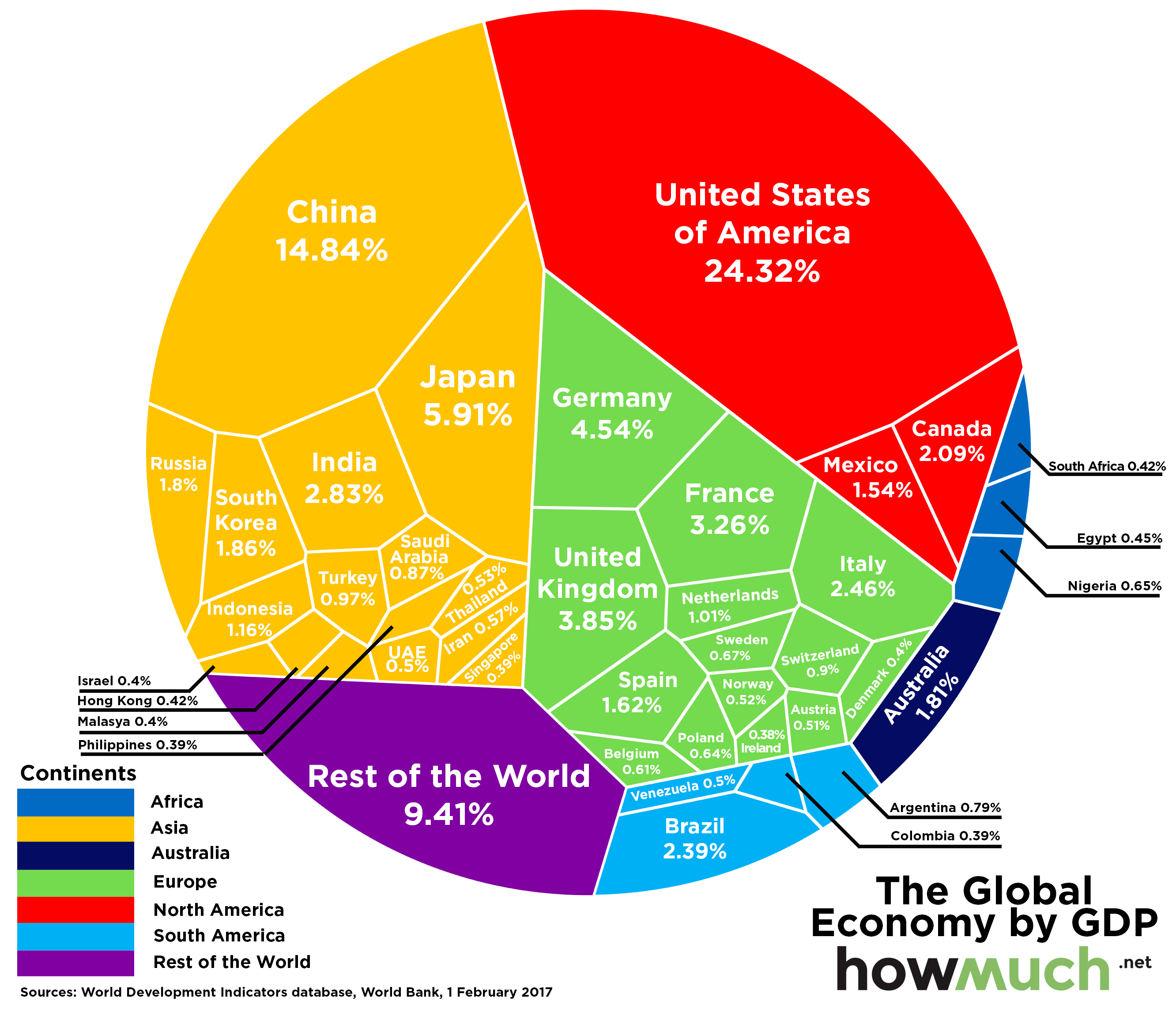

That’s OK too. Top to bottom, we’re the richest country in the world with the highest level of consumption on .. just about everything.

It is a big problem that healthcare is unevenly affordble. Do not mistake uneven affordability with uneven availability: the healthcare that people receive is far more equally distributed than the bills for it are. That’s a good thing. Maybe we can do better. But don’t break availability to fix affordability: this is why you can’t find an obstetrician in Las Vegas if you’re on Medicaid. You should be suspicious that one of the words in the formal title of the act that passed Obamacare is “afforable”.

It’s weird that half the country gets its health insurance through employers. This is a historical relic of World War II that should go away. Let it. Currently, the party that wants to do things (a little) differently is the Republicans. They were not this way before Pelosi, Reid, and Obama. The Democrats are not this way now; when they get their chance it will be nice if they are.

I was watching Bill Maher’s show the other night. He considers himself to be a solid Democrat/Progressive/Liberal. He stated his conception of healthcare provision quite clearly. What he described was a social security system for healthcare. I think a lot of people take that view (and I’m OK with it too). Fair enough. That is not what we have now. Some people do not favor a move towards a social security system for healthcare because we’ve screwed up our social security system for retirement. Again, fair enough. The economics are that social security systems are feasible, practical, and affordable. It’s the politics that goofs them up: people vote themselves out of the paying group and into the receiving group. If you don’t solve that problem first, your social security system for healthcare won’t work. Promise.

Senator Elizabeth Warren was on the same show. She’s presented healthcare as a uniquely American problem. It isn’t. Different countries just paper over the issues differently. Her entire set of positions lacks credibility once you recognize that. She’s a Democrat but there are people on both sides of the aisle that should be tuned out on that basis alone.

Macroeconomically, all countries suffer from the same problem. Data shows that every consumer treats healthcare as a luxury. Denying that is not helpful. This means they spend more on it as they get richer. So economic growth means a greater proportion of an economy devoted to healthcare. Except data shows that healthcare is not a dynamic, productive sector. That’s a problem. But there’s a really obvious implication: don’t bind it up even tighter (with regulatory and bureaucratic systems).

Once again, politicians have completely avoided the one simple way to make healthcare cheaper: shift supply to the right. That’s economist lingo for educate more doctors, nurses, and so on. It seems like everyone wants to go into healthcare because those are “good jobs”. If one industry/sector has “gooder” jobs, that imbalance isn’t sustainable. Unless, of course, the political system is preventing that. Get the message: Republicans and Democrats are prejudiced against all the people who don’t have an MD or RN after their names.

But, of course, doctors and nurses say that their pay isn’t enough to compensate them for all the hassles. Don’t make it harder for them. Again, D.C. seems to have real problems with this. Start by turning Medicaid into a program that pays its bills.