Given the two earlier posts (here and here), we know (roughly) why people get the amounts that they do from employment: that marginal income can’t vary too far from marginal productivity over the long haul.

But the trendy new idea being floated is decoupling. This is the idea that income and productivity no longer seem to be coupled together, with productivity rising at a consistently faster pace than income. Usually this is asserted to be a problem of the last 30 years.

But, we need to do two things to the data before we can talk fruitfully about inequality. First, we need to count all forms of compensation that are paid to labor. Second, we need to deflate that amount appropriately.

This is another situation in which people who want to advocate for a certain position are self-serving in their choice of solution to both problems. Currently, it is activists on the left of the political spectrum who are staking out positions with overly aggressive assumptions about how to address those two problems.

First up is compensation. Employees get paid in a lot of ways: wages, salaries, bonuses, piecework, commission, tips, price breaks on merchandise, and benefits. Benefits is the bugbear here. Most people in America get compensated with a lot of expensive healthcare, and most of them would choose to take some cash instead if given the opportunity. But they aren’t given that opportunity.

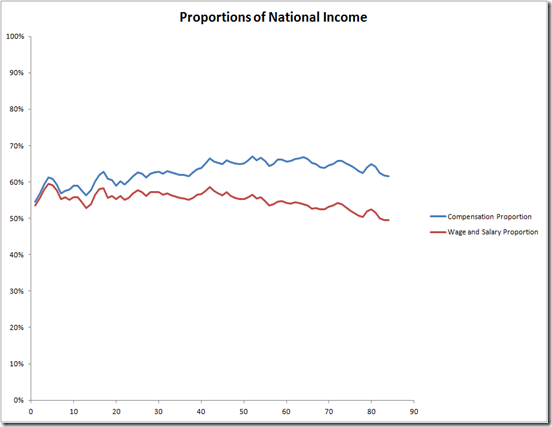

Here’s a chart I produced from Table 1.12 from the BEA. Some items are netted out of GDP to arrive at National Income. Compensation, and wages and salaries, are two components of national income.

I apologize for the lack of dates along the horizontal axis: Excel was not being cooperative. This is based on annual data running from 1929 to 2012.

The proportion of compensation rose steadily until around 1990, and it has dropped somewhat since then. This is related to the big tax reform passed in 1986: this made it easier for people to be paid with things like stocks and options. That’s something just about everyone wanted: it helps address the principal-agent problem between managers and employees. The thing is, that isn’t counted as compensation. Compensation is fairly regular payments for labor, while financial assets are counted as a form of ownership.

But the proportion paid out as wages and salaries peaked almost 50 years ago. That wedge you see opening up between compensation and wages and salaries is mostly healthcare benefits.

People who want to take the position that income inequality has gotten worse focus on the red line.

The second problem is how to deflate the nominal income data. Progressive advocates tend to argue that we should deflate with the CPI. The pro is that this tracks consumer purchases the best. The con is that it’s constructed with the Laspeyres’ method, which means it always overstates inflation.

That leads to a further problem. If the CPI overstates inflation every period, then the total overstatement gets larger with the passage of time. Thus income, deflated by the CPI, is likely to look most problematic in the most recent years. That’s good if you feel that progressives should be making hay while the sun shines.

I want to state clearly that using the CPI is morally worthy. We should focus sometimes on what consumers can buy with their income. And, while the Laspeyres issue is a big one, recall that the alternatives aren’t perfect. But, using the CPI also requires moral blinkering* about the technical aspects of measuring productivity (discussed in the earlier posts). Since the right income is related to productivity, and productivity is derived as a residual from GDP, the proper thing to deflate income by for this comparison is the same thing that GDP is deflated by, not the CPI. This is further buttressed by our theory of how compensation works: if the compensation decision made by an employer starts with a worker’s marginal revenue product, then what’s called for is a price index that matches up with that revenue, rather than how a worker spends the money derived from that. In short, the moral worth of using the CPI indicates that it should be used for some argument, but not for the one at hand.

Put this together, and advocates for a political addressing of income inequality use wages and salaries deflated by the CPI. The trendy word to describe this is decoupling: the idea that productivity is still growing but that wages and salaries deflated by the CPI are not keeping up.

What you don’t hear about much is what if you used compensation, and deflated with a chained price index. Don Boudreaux and Liya Palagashvili discussed this in a piece in the March 6 issue of The Wall Street Journal entitled “The Myth of the Great Wages 'Decoupling'”. When you make those two choices, you find no evidence of decoupling.

This is a form of the problem dubbed by Reenan and Pessao as net decoupling. Will Sham, writing at All Different Things defined that as “… the difference between GDP growth per hour and average compensation, with GDP deflator taken into account for both …”, in contrast with gross decoupling: “… the relationship between GDP growth per hour and median worker wages”. Reenan and Passao found that for the UK and the US, like Boudreaux and Palagashvili, that net decoupling is non-existent. But Reenan and Passao also found that gross decoupling does exist.

It’s easy to find people like Sham who are more concerned about gross decoupling (I know nothing of Sham, but I like his presentation of the progressive position on this issue). I think they’re right to focus on the median worker, but I emphasize that this is exactly the sort of comparison we shouldn’t be making with the data we actually have. The reason is that we don’t get median productivity data. By comparing average productivity data to median income data we will always find a problem. By all means we should encourage the creation of better data sets, but without that, I think it’s unethical to answer a question with the wrong data set.

All of these issues, and some additional ones, are covered in The Heritage Foundation publication entitled “Productivity and Compensation: Growing Together” by James Sherk. Do keep in mind that this source is not regarded as politically neutral.

Having said that, I don’t know many macroeconomists that disagree with my central points: 1) use a broad and inclusive definition of income from labor, 2) use a price index relevant to how employers think about all their cost decisions (including labor), and 3) don’t compare medians to averages. By that metric, the overreach of progressives is larger on this issue than most.

* Blinkering is a word I use often when talking about subjective positions in macroeconomics (I learned it long ago from other macroeconomists, and it’s the perfect word for me sometimes). Here’s a picture of blinkers:

The blinkers are the leather patches that limit a racehorses field of vision so that it thinks about only the dimension in front of it. When I talk about people taking positions because they’re blinkered, I mean that they (or someone else) is intentionally restricting their view to encourage that they think along one dimension.

No comments:

Post a Comment