Real growth in the 4th quarter was revised upward to an annualized rate of 3.0%.

Wednesday, February 29, 2012

Max

If you ask a vain professor in class what sort of dog they have, you get a video of his favorite one:

Tuesday, February 28, 2012

Chinese Reform Blueprint

A joint report of the World Bank and a division of China’s State Council entitled “China 2030” has been released (468 pages, all required … just kidding;). It is a blueprint for how China might transition from the easily earned high growth rates of a poor country playing catch up to the sustained and reasonable gains that might move it through the middle income range.

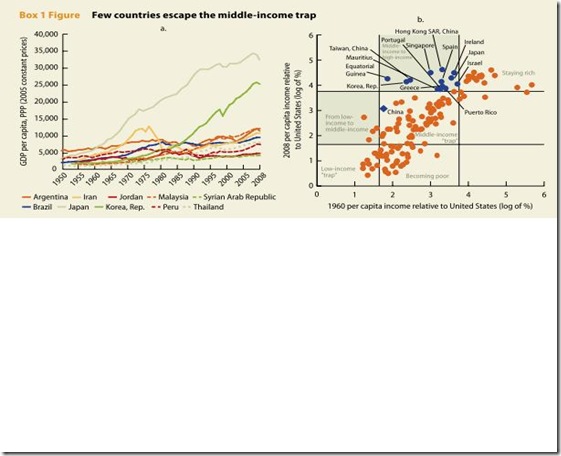

The problem is that only about 10% of countries have successfully navigated through that middle income range:

Many other countries that like China had reached so-called middle-income status—which the World Bank defines as annual per capita income of between $1,006 and $12,275—have failed to advance further up the income scale. Of 101 middle-income countries in 1960, only 13 had become high-income by 2008, according to the report.

Excuse the white space in the chart below … I’m working from a PC with a less than ideal suite of software available to me. Anyway, the chart on the right shows the odds aren’t in China’s favor.

China faces two big problems.* The one mentioned by the report is the large proportion of state-owned enterprises.

… The report also recommended "breaking up state monopolies or oligopolies in key industries," including petroleum, chemicals, electricity distribution and telecommunications, and letting private firms compete in some sectors the state deems "strategic."

…

Those recommendations could require big changes by the Communist Party—a subject the report doesn't address. For instance, the party's personnel department now hires and fires managers of state-owned firms, giving it vast power over the direction of the companies. The Politburo Standing Committee, the party's most powerful organization, sets broad monetary policy …

The problem with all this is that China’s economic growth over the last 30 years has been led by the firms that are not state-owned.

Robert Zoellick, a former Bush administration official, World Bank President, and a well-respected policy expert says:

If you ask whether the party can have a meritocracy that produces good leaders, my answer is they haven't done so bad so far.

This is a big deal this year because China is undergoing a scheduled leadership transition. The new guys seem to be on the right page though:

China's leadership transition begins later this year when Vice President Xi Jinping is expected to become the new head of the Communist Party, succeeding Hu Jintao. Mr. Xi has been briefed several times on the recommendations, said individuals involved with the report, while Vice Premier Li Keqiang, who is likely to become premier—China's No. 2 position—endorsed the preparation of the report after Mr. Zoellick proposed it in late 2010.

Another thing that makes me think the China 2030 report is worth taking more seriously is that the unit that co-authored it reports to the highest levels of the government, but the guy whose signature is on it, Li Wei, doesn’t even have a Wikipedia page. To me, this means this job wasn’t pawned off on some prima donna with their own agenda; if they take this seriously, and it works, the top brass can claim all the credit, and if they fail they can suppress the whole thing.

Read the whole thing, entitled “Blueprint of China Reforms Leaves Role of Party Vague” and “New Push for Reform In China” in The Wall Street Journal.

* A second is one observed by Paul Krugman about 20 years ago in a piece entitled “The Myth of Asia’s Miracle”: most growth in Asian tigers has come from a transition from inefficiency to efficiency, not because of any special improvements in productivity. This issue is mentioned in Supporting Report 2 of China 2030.

Thursday, February 23, 2012

Understatement of Real Wages

Economists generally understand that what we use as real wage data understates the improvements in real wages that have occurred through time. Out in the Wal-Mart parking lot, people like to deny this.

David Henderson at EconLog goes over three reasons:

- The CPI overstates inflation, because it can’t completely account for people switching towards cheaper products.

- We get a lot more, and better, health care as part of our compensation.

- Working conditions have improved just about everywhere.

- The risk of death on the job, which has a monetary value, is down across the board.

P.S. The next time someone bemoans the “fact” that women get paid less, remind them that death rates for “male” jobs are several times higher than for “female” jobs. That requires extra compensation for the living who undertake those risks.

Wednesday, February 22, 2012

Greece Downgraded Because of the New Plan

A new and improved plan to deal with Greece’s debt problems was signed on Monday.

As a result, Fitch lowered their rating on Greece on Tuesday.

Politicians and the legacy media think plans and agreements are a big deal. Investors know that following through with them is the real deal.

Tuesday, February 21, 2012

Employment and Unemployment by Degree

Here’s an interactive graphic that allows you to plot out unemployment rates by subsets of the population: choose gender, choose race, choose age group, and choose educational level, and it isolates the unemployment rate for that group.

Very cool. Very useful for pointing out stuff like the severe effects on men and the young in the last recession.

This is from a piece in the February 21 issue of The Wall Street Journal entitled “As Job Market Mends, Dropouts Fall Behind”.

Manufacturing and Politics

As near as I can figure, all the candidates are bending over backwards to “do something” about manufacturing.

A February 21 opinion piece from The Wall Street Journal entitled “Manufacturing Decline” marshals some facts.

The industry-in-crisis narrative usually begins in the aftermath of World War II, when manufacturing accounted for 25.6% of the U.S. economy. This is a less than ideal heyday to begin the time series, given that most of the developed world lay in ruins and their economies would recover. …

The U.S. economy has grown by a little under sevenfold since 1947 …

Manufacturing has retreated as a share of GDP and contributed 11.7% in 2010 …

The manufacturing crisis, if that's the word, has been jobs. Industry employed one of three workers after the war. Today, it's one of eight. Yet this, too, is largely a measure of economic progress—because it is the result of productivity gains …

Real manufacturing output stood at about $35,000 per worker in 1947, in constant dollars. It doubled by 1980 as companies became more efficient. Today this measure is an astonishing $150,000. Manufacturing productivity has increased by 103% since the late 1980s, outpacing every other industry and double the 53% in the larger business economy.

This translates to gains for consumers: Prices for manufactured goods have declined 3% since the 1990s, even as overall prices rose 33%. One reason manufacturing is shrinking as a share of GDP is that its costs are falling—unlike, say, in health care, with its negative productivity rate in the official statistics.

The big problem is that the political talk about helping manufacturing sounds like a substitute for helping housing and construction:

Which brings us to the real manufacturing tragedy, which is Washington's habit of misallocating scarce resources. There is only so much capital in the economy, and growth will be fastest if it is allowed to find its most productive uses. That is rarely the political calculus … Or take another sad case: For decades and especially the last 15 years, the government has been on an epic binge to push resources into housing.

The mortgage interest deduction ensures that a home is the largest investment most individuals make, while multiple home ownership programs compound the incentive. The Federal Reserve's monetary policy in the 2000s and today creates a subsidy for credit, which pushes more resources into finance and real estate in particular. Imagine how this era might have been different had investors in search of yield put their dollars into factories and exports, rather than mortgage-backed securities.

The double tragedy is that the political class seems intent on reviving industrial policy with special subsidies and tax breaks. Mr. Obama's well-worn demand is for more government "investments," especially in faddish manufacturers a la Solyndra, while at the same time he wants to punish multinationals that do business overseas. GM is now his totem, with its $7.6 billion profit for 2011, the auto maker's highest ever. But all that proves is that companies really can turn around when the government gives them $50 billion and uses brute force to reduce their liabilities.

Saturday, February 18, 2012

Why Is Macroeconomics So Hard? Misinterpretation of Social Loafing

This is convoluted; bear with me.

Misinterpretation of social loafing is then thinking that someone must be doing something because they are a member of a group.

An example of this is the recent debt ceiling debate.

In this case, both sides agreed that something needed to be done about government finance. Broadly, the Republican position — a very firm line on tax changes — was new. Broadly, the Democratic position — we’ve always increased the debt ceiling when we needed to — was not. I think both sides would agree that the whole debate was largely driven by Republicans defending an updated position. Here’s where the social loafing comes in. Three of the items that make macroeconomics hard are at play: 1) we’ve always raised the debt ceiling so we should this time too, 2) the Republicans have staked out a position to not raise the debt ceiling so being a Democrat means wanting to raise the ceiling, but there is also 3) some degree of social loafing. I believe many Democrats were uninterested in seriously engaging this problem because they were members of a group, and that membership gave them the appearance of doing something when they weren’t really doing anything at all.

There’s actually quite a lot of this around — even outside of macroeconomics — once you know what to look for:

- Accusations by the left that Obama is parroting defense policies developed in the Bush administration are an accusation of social loafing, while the acceptance of those policies by most Democrats because Obama is their leader are the misinterpretation.

- Being against gay marriage on moral grounds is not social loafing, but many Republicans who flex the party position in public are socially loafing. The misinterpretation shows when that moral flexing becomes a flexible moral position when this issue hits closer to home.

Broadly in macroeconomics, the current dynamic — where most Republicans support tax cuts and most Democrats support spending increases — is social loafing, and the belief that those groups are doing something worthwhile by not doing anything new at all is the misinterpretation.

Thursday, February 16, 2012

Fed Says Growth Is Not Accelerating

A summary of the Federal Open Market Committee meeting from about 3 weeks ago indicates that they don’t feel that growth is accelerating.

How Much Would a “Buffet Tax” Raise?

Obama is pushing for a minimum tax on millionaires*, the so-called Buffet Tax.

He has two goals: 1) raise more revenue, and 2) reduce the perception that the rich don’t pay enough taxes.

But, the tax isn’t predicted to raise much revenue. Here’s Robert Samuelson writing in The Washington Post:

… In September, the Congressional Budget Office estimated the 10-year deficit at $8.5 trillion. The nonpartisan Tax Foundation estimates that a Buffett Tax might now raise $40 billion annually. Citizens for Tax Justice, a liberal group, estimates $50 billion. With economic growth, the 10-year total might optimistically be $600 billion to $700 billion. It would be a tiny help; that’s all. …

Via Greg Mankiw.

* We’ve been down this road before. We’ve had a tax in place, the Alternative Minimum Tax (aka AMT) for about 40 years. It was put in place during the Nixon administration after it became public knowledge that in 1969 over 155 households with real incomes over $1.2M had completely avoided paying any income tax through the legal use of deductions. The AMT is now payed by about 4% of households, and a quarter of AMT payers report less than $200K in income.

Thursday, February 9, 2012

Breathtaking Cluelessness

If Bloomberg Businessweek was a teenager, it would be one of the annoying ones that tries too hard to be noticed by the popular kids.

So, to me, it’s not surprising that they have a piece this week on how much harder the economy has been on Obama now than it was on Reagan 30 years ago.

Arguably, this position is correct, but more reasonably the economy has been lousy for both of them. But they’ve gone way over the top to make their point in “A Tale of Two Election Year Recoveries”. As a student you need to start to recognize gross misinterpretations like this.

… President Barack Obama’s recession is a lot more complicated than the one Reagan tussled with in 1981.

Superficially, their predicaments are similar. Both presided over economic downturns considered to be the worst since the Great Depression.

Not exactly. Reagan had a full-blown recession that started 6 months after he came into office and lasted for 18 more. Obama took office with a recession in its 14th month with only 6 more to go. And, as horrible as that hard slide in 2008-9 was, we saw the first signs of the economy starting to bottom out just before Bush left office.

… They lost congressional support in midterm elections and were presiding over economic recoveries as they geared up for reelection campaigns.

Actually, only Obama’s party lost control of one of the houses of Congress. Reagan dealt with a Democratic House, and lost votes in the midterm elections, but he had a Republican Senate and gained a vote in the midterm election. Obama’s party had control of both houses for 2 years. Reagan never did.

Now the differences. The economy surged under Reagan. Gross domestic product in the final three months of 1983 rose at an annualized 8.5 percent. For Obama, the economic engine is running much more slowly. He narrowly avoided a double-dip recession in mid-2011, and growth accelerated in the fourth quarter to a 2.8 percent rate—the fastest the country experienced in 18 months. The unemployment rate in December 2011 was 8.5 percent, vs. 8.3 percent in December 1983. Yet joblessness 29 years ago dropped 2.5 percentage points in just 12 months, compared with a decline of less than 1 percentage point in 2011.

Correct me if I’m wrong here, but aren’t they saying that “Obama’s recession is a lot more complicated” because he hasn’t gotten the growth that Reagan did?

Most people conclude from this that Reagan had good policies and Obama not-so-good ones. Yet the tone here is that this is a problem that Obama had no hand in.

I’m not too much of an Obama basher, but I don’t think it’s a stretch to reinterpret this as: Obama’s situation is more complicated because he’s screwed it up worse.

Obama has struggled to master a far more complex situation.

I think it’s fair to say he has a different situation. “More complex”? I don’t think so.

… The Reagan recession was sparked by the high inflation of the Jimmy Carter years and the decision by then-Federal Reserve Chairman Paul Volcker to raise interest rates to as high as 20 percent in May 1981 to smother higher prices. Although the high rates caused a lot of pain, they left Volcker with plenty of room to cut until the recession had eased. Rate cuts started in June 1981. By December 1982, rates were down to 8.5 percent. The economy responded quickly to monetary easing. Fed Chairman Ben Bernanke, in contrast, has little room left for cuts; the federal funds rate is close to zero. “When you have a deep financial crisis paired with recession, it’s a completely different animal than a normal recession,” says Kenneth Rogoff, an economics professor at Harvard University. “The one in the Reagan Administration was a more normal one.”

Compared to what? How was Reagan’s recession more normal when Reagan had to deal with the highest inflation we ever had in a recession America? The name for this was stagflation, and it’s wishful thinking to call it normal. Our textbooks still don’t have a policy prescription for stagflation. Telling me that’s not a sign of a complicated situation is a fib.

The presence of so much debt in the economy makes companies and consumers reluctant to borrow and banks reluctant to lend, no matter how low interest rates go. Debt today remains a greater drag on the U.S. than in 1983 …

That is true.

Obama has worked with an economy that was weak even before the recession officially started in December 2007.

Ummm … no. The 2001-7 expansion was one of the longest on record. It was also fairly strong in 2003-6.

The expansion that started in late 2001 under President George W. Bush was among the most lackluster in modern U.S. history, providing little cushion against a possible downturn. By the start of the recession in December 2007, payrolls had grown less than 6 percent during the decade that started in 2000.

In order for payrolls to grow, you either need 1) lots of unemployed to re-employ, or 2) lots of young people entering the work force. The 2000-1 recession was so mild there wasn’t much unemployment, and I’ve already discussed in class that we are in a demographic period when people are leaving the labor force. So, low payroll growth was something most economists expected of Bush after he won the election.

… Payrolls grew 20 percent during the 1980s and 1990s and 27 percent during the 1970s. …

These two periods fit the two criteria I just mentioned for strong job growth.

Many of the jobs generated during the Reagan recovery were well-paid factory work. Although Billy Joel was lamenting the decline of Industrial America in his 1982 hit Allentown, manufacturers maintained considerable might in 1983 and 1984: At the end of 1983, almost a fifth of working Americans—19 percent—labored in manufacturing. Fewer than 9 percent of workers do today. “Back then a larger fraction of the workforce was in manufacturing,” says Soss. “And you hire those people back when business gets better. There’s less of that going on now.”

This is mostly true, although factory workers get paid more now because they are more productive.

“Reagan could talk about morning in America and could come from that perspective,” says Peter D. Hart, who was a pollster for Walter Mondale, Reagan’s Democratic opponent in 1984. “The major difference this time is that Americans are much more likely to believe we are in a long-term decline.”

I think the bigger question is why they might think that at all. Have you checked your closets lately? They’re full of stuff. Have you checked how many hours you spend not working? We have more leisure than ever. Have you checked on all the fun things you can do with your time? Life wasn’t always like this.

Note that I am not claiming that the last 4 years have been any fun economically. I’m just claiming that we should be realistic and recognize that we’re going through a once every generation event. Not a once-in-a-lifetime or once-per-century event.

New Kauffman Report

The Kauffman Foundation is a right leaning non-profit interested in economics and current issues.

They survey macroeconomists who blog every quarter to get a sense of how they feel about the economy. The participants tend to be right-leaning, but include quite a few solid Democrats.

Their latest quarterly report is out.

Anomaly In the Household Survey

There’s an anomaly in last month’s labor market data. I don’t know what to make of it; but some conservatives see some sneaky stuff being done to the data. I recommend we keep an eye on these numbers for a few months. Here’s what’s going on.

The Bureau of Labor Statistics determines the unemployment rate from two different surveys. Both survey physical locations.

One surveys households, the other survey “establishments” (basically, employers).

Similar questions are asked of both, but what people in a household consider employment can differ considerably from what a business would. So, the establishment survey is usually thought to be more definitive. On the other hand, it misses a lot of people doing unconventional jobs, particularly early in recoveries: starting businesses, working for new businesses that aren’t in the establishment survey yet, working off the books, and so on.

Normally, population rises every month, and you’d expect employment, unemployment and people classified as not-in-the-labor-force to go up too. Business cycle effects swamp the slow movement of population though. So, right now, you wouldn’t be surprised to find employment rising faster than population, and unemployment dropping. But what of not-in-the-labor-force?

Well … last month, not-in-the-labor-force went up by an extraordinary amount. Why is that so?

It could be that people dropped out of being employed, and decided to retire or otherwise take some time off. Except that unemployment went up, so there’s need to be an even larger group of new quasi-retirees to make the numbers work.

Or it could be that people are getting discouraged with being unemployed and have stopped looking. Except that the change is so large that if we counted all those newly not-in-the-labor-force people as unemployed, the unemployment rate would have gone up to 9.0% last month. The labor market may be soft, but that magnitude of change dwarfs what happened in the fall of 2008 when the economy was in a nosedive. No one is in a panic, so this story can’t work.

Or, it could be that all of a sudden, a huge number of teenagers came of age all in one month, or the armed forces discharged a million soldiers … or … or … a bunch of alien abductees were returned. That last one is no sillier than the first two.

More than likely this is all because of a correction for some past mismeasurement of the numbers. Fair enough: but then how is this revision going to filter into the other numbers? I have no idea: Table B in the technical notes to the news release indicate that about 75% of the increase in not-in-the-labor-force was due to better counting of women who aren’t working.

Tuesday, February 7, 2012

A Little History to Put Europe In Perspective

Tom Sargent, last autumn’s Nobel Prize winner in economics, discusses some historical precedents for what Europe is going through in “An American History Lesson for Europe” from the February 3 issue of The Wall Street Journal. Specifically, how our federal government did bail out its states in the 1790’s but did not bail them out in the 1840’s, and what that can tell us about how Europe might like to behave.

Saturday, February 4, 2012

Greece’s Numbers Aren’t Funny Enough

Logan brought up in class on Friday that Greece had fudged its government budget numbers in order to get into the European Union. More than once!

In the course of getting its affairs in order over the last 2 years, Greece brought back the head of the IMF Statistics division to improve the reliability of its data. He is a Greek national who has worked internationally for his career, and is unattached to the cliques that run Greek politics.

He now stands accused of having falsified Greek economic data to make it more favorable to Germany and less favorable to Greece.

He is facing life in prison.

No member of Greece’s government or top political parties has stood up to defend him.

All this despite a public letter from the head of Eurostat that defended Georgiou in no uncertain terms. Eurostat, Walter Radermacher wrote Dec. 1, "refutes all allegations that the deficit of 2009 was overestimated." The compilation of 2009 and 2010 data has been published "without any reservation ... in contrast with previous periods." Radermacher credited Georgiou and his staff with implementing "new and strengthened procedures" and "a high level of professionalism."

Read more here: “Blaming the Messenger”

Friday, February 3, 2012

Unemployment Rate Down

Down from 8.5% to 8.3% — a 0.2% drop last month.

But, here we go again with this nonsense about broader measures from CNBC:

The so-called real unemployment rate, which measures discouraged workers as well and is referred to as the U-6, nudged lower to 15.1 percent.

This measure isn’t “real” in the sense that we use the adjective real in other areas of macroeconomics.

Nor is the standard unemployment rate somehow now “unreal” or nominal.

The measure U-6 is just broader, and as discussed in the reading posted in the class folder on the G drive, and highly correlated (and therefore not adding much we don’t already know) to the standard unemployment rate.

Thursday, February 2, 2012

We’re # 2!

Criticizing the state of American manufacturing is commonplace.

Except that we’re currently # 2 in the world for expansion prospects:

And, we improved over last month.

Tell me again, why exactly, are we bemoaning the state of manufacturing? Oh yeah … because we have less job security than all the places at the top of the chart.

Read the whole thing, entitled “World’s Factories Pick Up the Pace” in the February 2nd issue of The Wall Street Journal.

Are We Not Returning to the Trend?

There’s a so-so piece on a problem we’ll be covering over the next month or so in the January 27th issue of The Wall Street Journal. The article is entitled “Recovery Doesn’t Feature Typical Snapback In Growth”, and it contained this graphic:

The issue we’ll be discussing is whether the economy does return to a trend line, and whether or not that question can even be answered.

The article is only so-so because it conflates some issues. For example, towards the top the authors say:

Economists note that while output, adjusted for inflation, is finally back to its pre-recession level, it still falls short if adjusted for population growth.

So, the author is correctly pointing out that if we’re going to feel better about the economy, it’s real growth has to at least cover population growth. But further down the authors note that

Population growth has slowed. And the gradual retirement of the baby boom generation means that the work force is shrinking as a share of the overall population. That will tend to slow the economy's natural rate of growth.

This is an argument for aggregate real growth being lower, but having a lower hurdle to clear because population growth is lower. That isn’t the same thing.

Also, scroll back up and look at the graphic. Note that the vertical axis is not on a log scale. This will tend to accentuate the deviation on the big end.

Further, that deviation on the big end is based on the orange curve, which is a forecast. Note that it isn’t really made clear that it isn’t real data, and we can’t be sure where it actually lies.

All in all, it’s an interesting and worthwhile point, but it’s badly done.

A Test of Keynesian Economics, Perhaps?

Spain has a lottery: El Gordo. A big, expensive, once-a-year, lottery, that nearly everyone plays.

It works a little bit differently than lotteries in America. Tickets have a small sequence of numbers. All tickets with a specific number are sent to wholesalers who sell them retail. When the winning number is pulled, there are many winning tickets: 1,800 tickets this year, each worth about $520,000.

This year, in a village of 70 households and 250 people, every person but one held a winning ticket.

This is a natural experiment in Keynesian fiscal policy.

Recall the Keynesian fiscal policy story: you dump purchasing power on people, and let the multiplier process spread the wealth. Typically, the government buys something, but you could view the government as buying back peoples’ lottery tickets in this case. Also recall, that in the Keynesian story, what the money is spent on is irrelevant. What’s important is that it is spent.

There has already been a short-term stimulating effect:

The only resident who did not win was Costis Mitsotakis, a Greek filmmaker, who moved to the village for love of a woman. It did not work out. But he still lives here in a barn he is restoring about half a mile outside the village. Somehow, the homemakers had overlooked him this year as they made the rounds.

Mr. Mitsotakis said it would have been nice to win. But he has benefited nonetheless. He had been trying to sell some land without much success. The day after the lottery a neighbor called to say he would buy it. The next day another neighbor called. But Mr. Mitsotakis refused to get into a bidding war.

Low Interest Rates Are the Policy

A few weeks ago I posted about Ken Kuttner’s research showing that home prices are inelastic with respect to interest rates.

His research is in response to the common claims that maintaining interest rates at a low level for to long during the weak recovery of 2001-3 led to the housing bubble and financial crisis that started in 2007.

I don’t really think that was an issue, but some people do.

Now, the Federal Reserve is planning on pursuing exactly the same sort of policy. The current plan is to keep rates low for the next 2-3 years.

Moving Laterally In Europe

The European Union still hasn’t figured out what to do about Greece.

But, they have spent their time coming up with new guidelines for the size of government deficits and debts.

My guess is that this is just all BS.

Most of the countries are already in violation of the debt target (on the right). And … in order to avoid getting worse on the debt, you (more or less)* need to keep your deficit above zero (on the left). But the target on the left is actually in negative territory, permitting a country to be passing on that count but making the other one worse.

Having said that, I have no problem with a country running a deficit or having some debt. I have a lot of problem with a country using deficits and debts as ways to avoid politically painful decisions.

Taken from “Europe Tightens Fiscal Ties” in the January 31st issue of The Wall Street Journal.

* Keep in mind that because this is a ratio, making sweeping claims is problematic: both numbers could go up while their ratio goes down, and vice versa.

Downgrade Graphics

You know the story of last month’s rating downgrades. This graphic may make the idea a bit stickier:

Here’s the source article entitled "Downgrade Hurts Euro Rescue Fund" from the January 14th issue of The Wall Street Journal.

Here’s an awesome interactive graphic with a chloropleth map from the same day from a piece entitled “Europe Hit By Downgrades.” Additionally, this shows all 3 rating agencies ratings for each country, side by side.

Lastly, here’s a completely different interactive graphic. This one shows the amounts that different countries are supposed to contribute to the EFSF. That emphasizes why the downgrade of France was such a problem: they are giving the second most money.

One thing to note from that last graphic: Greece is rated lower than Portugal, but Portugal is paying higher rates. This is a bit odd. What it reflects is that Portugal’s ability to repay their debt isn’t great, but they are not swamped with it, so it’s at least possible. Greece has so much debt that it probably isn’t possible at this point. What investors are thinking is that if they get in now (which drives the price up and the rates down), they may be part of bailout deal which will erase some of that risk.

The Jobs Picture

Ed Lazear, an economics professor who teaches at Stanford’s business school, had an op-ed in the January 20th issue of The Wall Street Journal entitled “The Jobs Picture Is Still Far From Rosy”.

… An improving situation isn't the same as a good situation. The labor market is still very depressed and is likely to remain so for quite some time. …

… Hires need to increase by over 30% to get back to 2007 peak levels.

…

There is one other troublesome factor. The labor market is fluid, and each month about as many workers are hired as are separated from their previous jobs. The hiring that occurs to replace lost workers is called churn. As James Spletzer of the Bureau of Labor Statistics and I show in a forthcoming article in the American Economic Review, churn hiring accounts for about two-thirds of all hiring. Churn is generally good for workers and good for the economy because workers move to better, higher-paying jobs where they are more productive. The typical wage increase when moving to a new job is around 8%. But churn is down by over 35% from the pre-recession level during the last quarter of 2007.

This means that even people with jobs aren't doing as well as they should be. Because of the slack labor market, many are stuck in their current jobs, earning less than they would in a vibrant economy.

These are similar conclusions to the powerpoint presentation on JOLTS data I’ll cover in class.

Other Credit Ratings

Just some trivia for perspective on discussions about credit ratings.

1) What state has the lowest credit rating? You might think California, but it’s actually Illinois.

2) Does anyone’s rating ever improve? Yes. Indonesia’s rating just went up.

FWIW: Illinois is still 7 notches higher than Indonesia.

Oops

I discussed in class that the European Financial Stability Facility (EFSF) might be downgraded.

The EFSF was downgraded, to the same level as France, on January 16, and I missed it.

This was the Monday after the big announcement of 9 downgrades on the previous Friday. My guess is that they split the news into two parts so as not to roil markets too much,